The Forex Trading Coach Review Forex Training & Education

Contents:

Price changes as supply and demand change… supply and demand change based on the beliefs of market participants, or more correctly on the decisions of market participants to act on their beliefs. Let‟s summarise this section – How does price move? Price movement results from a supply/demand imbalance Changes in supply and demand occur as sentiment changes within the market participants.

A better way to trade is to understand the CAUSE of price movement. Had the move failed at B, sufficient opportunity would be available to scratch the trade for either a small profit or a breakeven result. In chapter 5, we’ll review a number of trade examples, from start https://forexarena.net/ to finish. A common complaint with trading books is that authors always seem to show the best trade examples; those that move immediately from the entry trigger to great profits. Interestingly, I have also felt this temptation – ego is an amazingly powerful force.

Your thoughts on your trading performance are most likely subjective. Even though the bottom line doesn’t lie, as humans, we tend to look for all kinds of excuses for bad trading. A trading coach will show you what you’re doing right and try to eliminate your trading mistakes as much as possible. Do you remember your first steps in playing chess or riding a bicycle? Most likely, you’ve had a mentor who showed you the basics of chess playing or how to keep your balance on a bike. You need to learn the basics first and then slowly gain experience, which will eventually make you a successful trader.

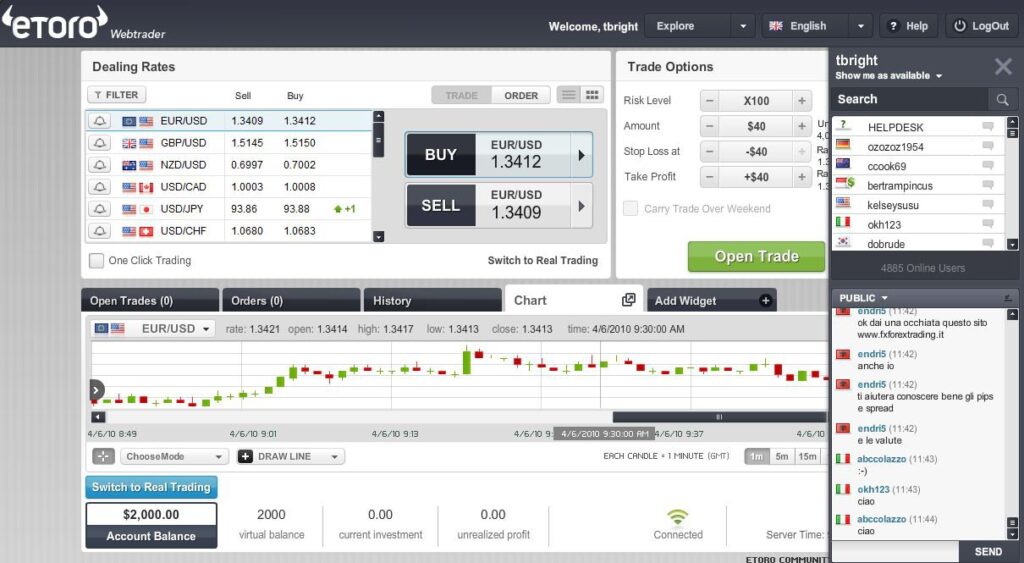

While at first I struggled with some of the industry jargon – and I believe the inclusion of a glossary would be helpful – once through the basics, my understanding of forex has rapidly increased. The course material consists of a series of how-to videos backed up with a 80 page manual. These webinars – there are many years archived – have provided much clarity to the course notes and instructional videos. There are also Daily Trades published each morning, which are very helpful in offering students the chance to practically apply the course. Andrew is a respectful and approachable teacher, and his league of supporters is testament to the beautiful simplicity of his successful trading system and method of teaching it.

The Trading coach

You need to embrace subjectivity and feel the market. Let the market action tell you where it‟s going. The following sections will involve subjectivity in many areas, in particular in the definition of our framework and of our trend. More discussion will be provided in the appropriate sections on how that subjectivity is applied. Sideways Trend – From the Perspective of Supply & Demand and Trader Decisions The defining price swing has established a lower price area at which traders perceive a good buying opportunity.

Bellafiore, Michael – Moneyshow.com

Bellafiore, Michael.

Posted: Tue, 02 Jan 2018 18:04:40 GMT [source]

When seeking to improve your trading, this can be overwhelming. That said, you can often narrow your search down quite quickly by following a few simple guidelines. A coach who is a trader will claim to have definite advantage over someone who doesn’t trade. This may be true if the coach has the track record to back up this claim, but just because a person is successful at trading does not mean that they can effectively relay that skill to someone else.

A trade short the YM and short the ES, both risking 1%, is often a single trade short the US index futures with a risk of 2%, due to the high correlation of these markets. Trade management involves moving the part one stop behind significant candles, in order to avoid giving back profits. On achieving the breakout, the stop is moved to breakeven . On the close of candle D, the stop is moved to S3. On the close of candle E, the stop is moved to S4. Step 3 – Trade Management & Exit In figure 5.112 below, we see candle A triggering the entry, followed by candle B making the breakout to new highs.

Andrew Mitchem

The content is so honest and transparent that I took his private coaching shortly after completing the course. I have been doing private coaching sessions weekly with Cory for the past couple of months and seen an astronomical improvement in my trading performance and overall quality of life. I now have a deeper understanding of the real “Market Structure” and the importance of trader psychology and discipline. I am currently still training with him and highly recommend his coaching to anyone interested.

How price reacts there will define our bias for future price action and our actions with respect to trade opportunity. This is particularly so for areas such as those at D which define the upper and lower edges of the Asian session range. These S/R areas are commonly watched in the forex world, with many traders aiming to play any breakout from this range. Once again, we don‟t automatically trade a breakout. This is demonstrated in figure 2.14, where the EMA 10/20 cross enters long at price level A, after price has moved sufficient distance in the long direction in order to trigger the cross. The EMA 10/20 cross enters short at price level C, after price has moved sufficient distance in the short direction in order to trigger the cross.

Live trading provides us the opportunity to continually practice our analysis; and our market review sessions and simulator replays provide the opportunity to compare our performance with hindsight perfection. Replaying the patterns your trading coach review of market behavior reinforces our intuitive ability to read and follow the flow of price. However you don‟t need to be trading live to benefit from this. Practice can be achieved right now through conducting live market analysis .

+3.3% for the week by risking only 0.25% per trade. Very happy my bank has increased by 7.14%I have just ended my first live month trading. Very happy my bank has increased by 7.14% – much better returns than National Bank. Very pleased with the Course Notes and learning and listening to the others on the Webinar.

1) To share with you the way that I view the financial markets and the way that I use price action to identify and manage trade opportunity. 2) To share with you the development process that I believe you need to follow in order to become a consistently profitable and professional trader, regardless of the strategy you choose to implement. Of these two primary aims, the second is by far the most important. New traders mistakenly believe success is all about the right knowledge and the right strategy. While this is important, they fail to understand that becoming a trader is really a process of growth and development. Success is not a result of one day finding the right combination of indicators or parameters and the right set of trading rules.

We’ll see the true nature of price movement and the way that I view markets that allows me to identify areas of trade opportunity. You’ll come away with not only a new understanding of the markets, but also an understanding of why most traders lose and why most other systems are ineffective. Chapter 3 of the series covers market analysis. You’ll learn how I analyze price action within a framework of support and resistance. You’ll learn to develop a bias for future price action, and update that bias as the market data unfolds bar by bar. 1.1 – Introduction Welcome to the YTC Price Action Trader.

FREQUENTLY ASKED QUESTIONS about this trading psychology course

Andrew is a Trader first and coach second, which is a relief from the many forex experts who teach but don’t trade themselves. Finally I wanted to thankyou for this forextradingcoach system and I hope I can report further better results for my trading. I want to thank Andrew for all his support, methods and tools. And I want to encourage him long last trading and to provide us with trading knowledge and such amazing tools and templates to keep our accounts rising. Like many others I have tried other courses and spent alot more and at the end they’ve all confused me!

For the purposes of this Forex course review, I registered for the course quickly and easily on the website. The course is designed not only to prevent traders from wiping out quickly, but also to give them the tools they need to continue trading based on technical analysis on a long-term basis. I’m usually skeptical about online Forex courses, but The Forex Trading Coach put me completely at ease from the beginning, which I believe was due to his efforts to connect with me from the start. As its name suggests, TheForexTradingCoach.com (aka “The Forex Trading Coach”) is a course that differs dramatically from most other Forex courses we’ve reviewed. For starters, it is not run by a big institution or a group of traders.

First of all, I have never written a review for anyone or thing, but I must say something about this program. If you want to learn to trade the forex market invest in this program. Take the time to learn it, trade in demo, follow along in the webinars provided by Andrew, ask any questions you may have and you will learn to trade in a confident manner.

Creating Your New Trading Persona

Please note that limiting risk through the use of stop losses does not guarantee the risk is limited to that amount. In most markets a stop loss order when triggered generates a market order designed to exit you from your position. As the intraday Flash Crash of May 6th, 2010 showed, in conditions of extreme market panic there may not be any orders taking the opposite side of your market order. A lot of traders lost a lot of money on that day. Be familiar with exactly how your broker executes and manages their orders.

- With my background primarily being in forex, these changes had to be determined solely through price action, as demonstrated already.

- He sends daily email with his trade selection and we have webinars twice a month.

- For now, let‟s just identify two targets, T1 and T2.

- Right now they‟re in extreme drawdown and much stress, praying for any opportunity to get out at breakeven or at least as close as they can.

- The first price someone was willing to sell becomes the open of the first post-news candle, leaving a gap on the chart of approximately 10 pips.

- The lower the chosen timeframe; the more detail available to the trader.

Chapter 3 already showed us how to identify weakness. We now use the same analysis concept to identify our areas of trade opportunity. We look for weakness in several key areas – around S/R (higher timeframe S/R, range S/R, key swing H/L) and at pullbacks in a trend. Traders entering in the direction of weakness, right into an area of S/R, are taking very low probability trades. The push into this region is most likely to fail.

Late shorts desperately chasing price lower and lower in panic, along with previous longs in an extreme drawdown exiting at the point where they just can‟t take the pain any longer. Once the selling is exhausted, the professionals will be buying, driving prices higher and trapping the late shorts into a losing position. Any reversal may again be quite rapid, as the trapped shorts are stopped out of their positions and more longs are attracted to the market. But excessive acceleration is unsustainable, and likely to end in climactic exhaustion and potential reversal. Placing the degree of acceleration into the context of background market action will usually identify which of these scenarios is playing out.

Wedge Pattern Forex

Contents:

Both the upper resistance and lower support lines also converge as price moves lower in a narrowing range. With descending wedges, the upper and lower trendlines are drawn by connecting the lower highs and lower lows to form the familiar wedge shape. However, the confusion with the rising wedge pattern is that it is difficult to accurately determine whether it is a continuation or trend reversal. This makes rising wedges among the most reliable patterns in technical analysis but also among the most complicated trading strategies you can find in forex trading.

Spend some time simply scrolling through Forex charts and looking for wedge patterns. Draw the trend lines so you can be sure of what you have discovered. Save images of those that were particularly well-formed and generated great signals. An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline. The pattern is considered a continuation pattern, with the breakout from the pattern typically occurring in the direction of the overall trend.

In the https://forexarena.net/ below, you can see how the rising wedge pattern looks in a bullish long trend. In this case, the market is still in a bullish bias and the ascending pattern simply indicates corrections in the trend. In the first chart below, there is a rising/descending wedge being formed after an uptrend. This means that the sellers are matching the buyers, squeezing the price into a tight range, so a reverse could be near.

The ability to read the market not only helps to survive in difficult situations but also to earn money with familiar patterns. Its effectiveness is high, but if you add VSA-analysis elements to your trading method, the result will be even better. The fighting between bulls and bears does not cease, and the ordinary trader needs to determine which of them dominates in order to take the side of the fittest. All information on The Forex Geek website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income, expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed.

Only single detail has attracted our attention – long white candle (we remember that it is called a Marubozu, right?). This looked like shift in https://forexaggregator.com/, but we didn’t have much confidence with that yet. During wedge forming time exhaust those participants that direction of wedge is. So, if wedge is down – hence sellers will exhaust and buyers will win, the same is true for up wedge. So, a Wedge pattern could be viewed in a couple of shapes – as a rising and as a falling one.

What is a Falling Wedge Pattern?

This forms the left shoulder, head, and right shoulder of the pattern. The neckline is drawn through the lows of the left shoulder and head. A reversal is confirmed when the market breaks below the neckline and moves to new lows. A trend channel is a set of parallel trend lines defined by the highs and lows of an asset’s price action.

The https://trading-market.org/ of the pattern itself is the same, but it could have different direction – upward or downward. To do this we take the range from the widest part of the wedge – this gives us an expected breakout range for the market to rise. The example above, it shows that these lines give us strong indications of the price rejection.

Wedge Pattern Trading

This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

- The breakout of the flag is our signal to join the trend and enter a trade.

- On higher timeframes like weekly or monthly charts, the Wedge may give stronger signals.

- The trade-in in this case had a very favorable risk-reward ratio since the limit was set at the previous swing low.

Simpler patterns include wedges and triangles, whereas more complex patterns include head and shoulders, rounded bottoms and tops, and double and triple tops/bottoms. Read our complete guide to stock chart patterns for more information. Our web-based trading platform allows traders to automatically scan for wedge patterns using our pattern recognition scanner. However, not all wedges highlighted may be ones you would trade. Use your discretion in assessing whether the price has contracted to form a wedge. When a falling wedge occurs in an overall downtrend, it signals slowing downside momentum.

Wedge

Let’s add another chart that shows rising reversal wedge – just to show what it looks like. I will not show you rising continuation wedge, because it very similar to falling. Hence, according to our rules, sellers should exhaust during the wedge and buyers will win – the up move should continue.

Canadian Dollar Outlook: USD/CAD Price Seeks Breakout Ahead of Canadian GDP – DailyFX

Canadian Dollar Outlook: USD/CAD Price Seeks Breakout Ahead of Canadian GDP.

Posted: Tue, 28 Feb 2023 08:56:06 GMT [source]

As the name indicates, a triangle is formed when the top and the bottom trend lines culminate in a single point, confining the price in between them. In a wedge, the price breaks out in either direction before the two trend lines meet. In the images below you can see a triangle and a wedge being formed. The next chart example shows an ascending wedge pattern that formed during a downtrend. Here also, the trendlines started to converge as price moved higher within a narrowing range towards the end of the pattern.

Support

Next, you’ll want to look for a faltering upward momentum around support and an eventual breakout from the wedge to the downside. Put 1% of your account balance in a short position when this happens. We have a separate guide that explains the principles of support and resistance if you don’t know what a support zone is.

A wedge is a price pattern marked by converging trend lines on a price chart. The two trend lines are drawn to connect the respective highs and lows of a price series over the course of 10 to 50 periods. The lines show that the highs and the lows are either rising or falling at differing rates, giving the appearance of a wedge as the lines approach a convergence. Wedge shaped trend lines are considered useful indicators of a potential reversal in price action by technical analysts. But currently it is better to treat wedges mostly as indecision patterns, although it more gravitates toward reversal nature than to continuation nature.

Graeme has help significant roles for both brokerages and technology platforms. In this graphic, the blue line represents the line of resistance for the price highs, while the orange line marks the line of resistance for price lows. Understanding markets gaps and slippageThe foreign exchange rate reveals valuable details about particular currencies a trader wishes to trade-in. One of the most popular trading markets in the world, the foreign exchange market allows investors to make quick money by trading currencies. How to Add MT4 IndicatorsMetaTrader 4 comes with several built-in and custom indicators to boost your trading strategy.

Let us assume that the same currency pair that picked up on an uptrend in the previous example continues to be in the uptrend for the next five months. The currency pair is currently trading at a price level of 3.2, which is very close to its resistance level of 3.5. Due to another economic announcement in favour of the Euro, the exchange rate starts rising even more as the market continues trending in an uptrend. Wedge patterns are known as trend reversal chart patterns and can signal either bullish or bearish reversals. The rising wedge is a bearish formation so traders will sell the market. The falling wedge is a bullish formation so traders will buy the market.

Like almost all chart patterns, there is the opposite of the rising wedge as well. Notice that the trajectory of the lows was not as strong as before, and then of course the highs were becoming as aggressive as well. The first thing that we need to do is identify what a wedge actually is. A wedge is simply two trendlines that converge towards an apex.

The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners. Usually happens within an uptrend, whether a long-term or short-term one, when the pressure from the sellers starts to catch up to the buyers. CEO Valutrades Limited, Graeme Watkins is an FX and CFD market veteran with more than 10 years experience. Key roles include management, senior systems and controls, sales, project management and operations.

If the market is in a downtrend, you should look for a bearish wedge pattern to form below the 30 level on the RSI. And if the market is in an uptrend, you should look for a bullish wedge pattern to form above the 70 level on the RSI. One huge mistake that a lot of traders make is that they get concerned when a trade does not go in their direction or hit their target right away. Remember though, time and price are two totally different things and even if you do have a trade workout, it will work out on whatever the market schedule is, not yours.

Then, whenever you identify a rising wedge pattern near one of the Fibonacci levels, you can take it as a strong indication for reversal rather than correction. The rising wedge chart pattern is a recognisable price move that’s formed when a market consolidates between two converging support and resistance lines. To form a rising wedge, the support and resistance lines both have to point in an upwards direction and the support line has to be steeper than resistance. Our final trade example shows an ascending wedge pattern that appeared on a four-hour timeframe, right at the end of a bullish trend. This is another great example of how momentum declined on the MACD indicator during the wedge formation before price broke the support line and a strong reversal followed.

As you draw the two trendlines, you can see that a wedge is most certainly forming. Beyond that, we reached the blue line which represents the top of the wedge almost immediately on the breakout. The stop loss would have been on the other side of the wedge, which also would have been supported by the hammer that made up the last candle of the wedge before the breakout. If you look forward several days, you can see that the same area offered support on a pullback at least twice. This is quite common when it comes to market patterns, as it is a phenomenon known as “market memory”, which is where support becomes resistance in vice versa.

Dragonfly doji hi-res stock photography and images

Contents:

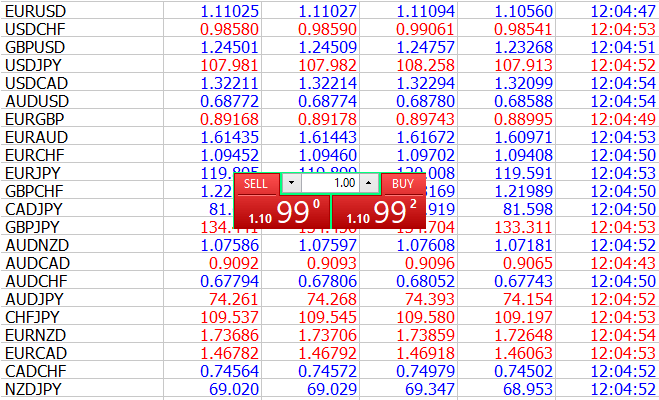

You can see how there is an obvious difference between where the pin bar opened and where it closed. If you’re looking for a dragonfly doji confirmation, you should pay attention to its next candle. Because understanding the meaning is what matters, not trying to memorize the exact candlestick pattern. So again, the close and the open is the same level but the difference this time around for Dragonfly Doji is that the candle has a lower wick. The three different types of Doji candlestick pattern that you must be aware of. Welcome back to this training video where you will learn all about theDoji candlestick pattern.

That often signs the end of the pullback and the start of the new leg to the upside. Just wait for a pullback to start, and then spot when the Dragonfly Doji appears. What makes a pattern valid is not just the shape, but also the location where it appears. The candle may or not have a wick at the top, but if it has, must be small. In the past, we have looked at several of these patterns, including evening and morning star, the hammer. And the gravestone Doji, which is one of the three popular Doji patterns.

In other words, dragonfly doji candle can means price exhaustion in a downtrend and potential price reversal. Dragonfly doji candle and gravestone doji candlesticks are very similar, and we discuss the difference further. Most of the technical indicators or patterns are indicative of reversal patterns.Hence they are neither bullish nor bearish. Also usually traders even if the pattern appears will wait for the next day to verify.

Get TrendSpider Apps

There are usually slight discrepancies between these three prices. The example below shows a dragonfly doji that occurred during a sideways correction within a longer-term uptrend. The dragonfly doji moves below the recent lows but then is quickly swept higher by the buyers.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

When you see this chart, it can difficult to just trade off it directly. It’s like a regular Doji but this time around, the highs and lows of the candle is very long. Whether you want to capture a swing or whether you want to capture a trend, you can use the appropriate trade management or trailing stop loss technique. You can go short on the next candle, stop loss above the swing high and depending on whether you want to take a swing or not. That is the key thing down here and you have to kind of anticipate that there are variations that could occur, especially in the FX markets.

Significance of Dragonfly Doji pattern

Tradingindepth.com is not liable for any damages arising out of the use of its contents. When evaluating online brokers, always consult the broker’s website. Tradingindepth.com makes no warranty that its content will be accurate, timely, useful, or reliable. Make sure you understand the difference between hanging man candle, hammer candle, and dragonfly doji to prevent from false interpretation. One thing to share first is don’t make this mistake when you’re trading the Doji candlestick pattern. And it’s really not too important to concern yourself whether there is a small body or no body on the candlestick pattern.

Of course, it occurs very rarely but price reversal happens constantly. Thus, this candlestick is not considered a good indicator for reversal patterns. They create orders immediately after the trend of confirmed by the next candlestick. Conversely, when the market has shown an upward trend before, a dragonfly doji might signal a price drop, known as a bearish dragonfly. The downward movement of the next candlestick will provide confirmation. A bearish abandoned baby is a type of candlestick pattern identified by traders to signal a reversal in the current uptrend.

As shown below, the dragonfly doji has a similar appearance to the hammer pattern or capital letter T. In this article, we will look at the dragonfly doji, which is another popular type of the pattern. Dragonfly Dojis are said to be red or green depending on the direction of their next candle. Dragonflies that appear during uptrends will often show as a green Dragonfly and vice versa for downtrends. In this article we will dive into how to spot a dragonfly doji. The best strategy to trade it and examples of how they have played out in the past.

Probability of a reversal

For example, the ability to withstand losses or to adhere to a particular dragonfly candlestick program in spite of trading losses are material points which can also adversely affect actual trading results. Support and resistance levels are great places to find price reversals. The Dragonfly Doji pattern is also a mirrored version of the Gravestone Doji candlestick pattern. Everything that you need to know about the Dragonfly Doji candlestick pattern is here. In most cases, a dragonfly doji is usually viewed as a more accurate sign of a reversal.

How to Read Candlestick Charts for Beginners • Benzinga – Benzinga

How to Read Candlestick Charts for Beginners • Benzinga.

Posted: Tue, 22 Feb 2022 08:00:00 GMT [source]

Dojis are differentiated by the location of the open and close on the wick — where trading begins and ends on a given day. A Doji indicator is mostly used in patterns, and it is actually a neutral pattern itself. By itself, the Doji candlestick only shows that investors are in doubt. However, there are main patterns that can be easily found on the chart. This candle pattern will help traders see the existence of support and demand. The problem with dragonfly and gravestone doji candles is there is no candle body, which makes it impossible for the candle to actually close into the body of the previous candle.

Candlestick Pattern

As you can see the price was in a minor downtrend when the price opened sharply lower and then ended the day close to where it opened. On the other hand, if the market has shown an upward trend previously and a formation might signal an upcoming decrease in the price of the security. The downward movement of the next candlestick will confirm the downward trend. The Dragonfly Doji is a specific type of candlestick pattern that can occur at the end of an uptrend.

The Dragonfly Doji candlestick pattern is formed by one single candle. Dragonfly Doji Candlestick, gravestone doji is a candle stick pattern with open, high, and low close patterns. In this case, traders may want to see if Dragonfly has any confirmation which will be seen in its next candle or candles after it occurs. The Gravestone Doji is a Japanese candlestick in which the open and close price of the candle is at the same level or is very close to the same level.

It is a transitional pattern as opposed to a reversal or continuation pattern. Traders should also note that just because you see a confirmation, that does not necessarily mean that there will be a reversal. Apart from the regular pattern of Doji, we also have the gravestone pattern.

The https://g-markets.net/ should be verified by waiting for trend confirmation on the following day. Naturally, dragonfly patterns form at the bottom of a downtrend or where the price has found support. Short Line Candles – also known as ‘short candles’ – are candles on a candlestick chart that have a short real body. Investopedia does not provide tax, investment, or financial services and advice. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal.

A doji is a name for a candlestick chart for a security that has an open and close that are virtually equal. Dojis are often used as components in patterns used to detect trading opportunities. Dragonfly dojis are very rare, because it is uncommon for the open, high, and close all to be exactly the same.

Its unusual ‘T’ shape indicates that a stock is beginning on a downward trend and reversing itself to close near the same price. As a result, dragonfly doji patterns are helpful in identifying potential trading opportunities. Dragonfly dojis gain significance when they are formed during the uptrend or the downtrend. The formation announces a potential reversal after a long downtrend in the stock prices, especially when the lower shadow is considerably long. Dragonfly doji means that sellers had the full control during the initial phase when the price opened and they took the price down to the lowest level.

Any candle which has a wick at the end tells us the banks took some kind of action during the time the candle was forming. This tells you that, “hey, the market is willing to buy at these higher prices, and there’s a good chance that this market could breakout higher and you can look to trade the break out of the highs.” You can see the market rejected higher prices and finally closing near the lows. Often what I see traders do is that when the market moves up higher and then there’s a Doji.

These candlesticks are neutral in color, such as black, and should be bought if the price breaks through a significant level of support. This doji candlestick formation is cautiously looked upon by the market players traders who follow technical analysis using price charts and patterns. Formation of dragonfly doji is used to decide the potential moves in the future – like, if already holding a position, then should it be closed at a profit or loss, or should it be held on to. A dragonfly doji candlestick pattern is formed when a candlestick has the same high, open, and closing prices. The candle can be on all timeframes, including on a daily, hourly, and 30-minute chart.

Best Bollinger Bands Settings

Contents:

Browse our collection of platform trading tutorials to get started. A stochastic indicator is another well-known technical analysis tool. Like Bollinger Bands, Stochastic indicators can help traders identify overbought and oversold levels. Values are compared to Bollinger Bands at 1.0 standard deviation above and below the selected moving average.

Bollinger uses these various M patterns with Bollinger Bands to identify M-Tops, which are essentially the opposite of W-Bottoms. According to Bollinger, tops are usually more complicated and drawn out than bottoms. Double tops, head-and-shoulders patterns, and diamonds represent evolving tops. Bollinger Bands are often used to identify M-Tops and W-Bottoms or to determine the strength of the trend. Using the trend guidelines, here are the summary guidelines for spotting reversals.

Bollinger bands settings for swing trading

As we previously mentioned, Bollinger Bands indicator measures the volatility on the market. A narrow band means indecision on price movement and when this happens, it is almost always guaranteed that markets are about to move either up or down. The Bollinger Bands are trading bands that focus on volatility. By allowing the movement of prices themselves to set the width of the bands, John Bollinger’s Bollinger Bands can react quickly to market conditions. Bollinger Bands have now been around for three decades and are still one of the most popular technical analysis indicators on the market. That really says a lot about their usefulness and effectiveness.

Crypto Market Forecasting With Indicators – Investing.com India

Crypto Market Forecasting With Indicators.

Posted: Thu, 09 Feb 2023 08:00:00 GMT [source]

A double bottom occurs when there is a fall in price, followed by a rise, followed by another fall that is close to the previous low, and finally another rise. With this strategy, I want to satisfy 3 conditions before I open a position. I was using volatility bands but without this unique knowledge and usually l was about to fade out. If the bands are sideways i place my take profit a few points below the upper band. I’ve never used this indicator before and after following Mr Bollinger on twitter for a while now, I’m more interested to consider his indicator in my charts. The Bollinger Bands indicator is great for identifying areas of value on your chart.

Daily Price Chart

For example, a level, at the crossing of which you need to buy, etc. In the case of our strategy, it makes sense to add levels 0.8 and 0.2. Colors – here you can set up the color, thickness and look of the indicator line. By default, it is bright yellow, so it is better to immediately change it to a more vivid color.

It’s popular among beginner traders due to its simplicity. Many professionals favor stochastic oscillators because of their signal accuracy and versatile applications. Bollinger Bands should be used in conjunction with other technical analysis tools. You can refine your search using other tools that we used in the described strategies. For example, you can use the RSI readings to select trading instruments for which you should enter the market right now.

Bollinger Bands

Normally, these price channels move across the chart symmetrically, but the distance between the bands varies significantly in certain market conditions. The volume-weighted average price is another tool that traders can use to spot trends and otherwise assess market data. While both Bollinger bands and VWAPs track the average price, VWAP also accounts for the volume of transactions at any given price. This can be a crucial difference for traders who use volume as a part of their trading strategy. A Bollinger Band® is a momentum indicator used in technical analysis that depicts two standard deviations above and below a simple moving average.

The https://forexarena.net/ is likely to head up when it is higher than the 20-period MA and when it goes beyond the upper band. The upper band demonstrates statistically higher prices. Some prefer to connect the top or bottom of the price to determine the upper or lower extremes.

Essentially you are waiting for the https://forexaggregator.com/ to bounce off the bands back to the middle line, which carries a high winning percentage over time. Notice how NIO gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded the high of the first candlestick. These sorts of setups can prove powerful if they end up riding the bands. To the earlier point, price penetration of the bands alone cannot be a reason to short or sell a stock.

We provide a risk-free environment to practice trading with real market data over the last 3 years. That doesn’t mean they can’t work for you, but my trading style requires me to use a clean chart. To this point, we applied bands to the Proshares VIX Short-Term Futures to see if there were any clues before the major price movement we discussed earlier. Notice how the Bollinger Bands width tested the .0087 level three times. The other point of note is that on each prior test, the high of the indicator made a new high, which implied the volatility was expanding after each quiet period.

Technically, prices are relatively high when above the upper band and relatively low when below the lower band. However, “relatively high” should not be regarded as bearish or as a sell signal. Likewise, “relatively low” should not be considered bullish or as a buy signal. As with other indicators, Bollinger Bands are not meant to be used as a stand-alone tool. Chartists should combine Bollinger Bands with basic trend analysis and other indicators for confirmation.

Ideally, we want a buy crossover above the 0 level and a sell crossover below the 0 level. But markets are not perfect, so we must adapt to current conditions. We use a higher number of periods on the CCI in order to smooth the indicator. The Commodity Channel Index is an oscillator used in technical analysis in order to measure the variation of a security’s price from its statistical mean. When the price reaches this area, we look at the Stochastic Oscillator to enter the market. Ideally, we want the Stochastic to be in an overbought area.

As you can see from the https://trading-market.org/, the first red candle after the highs was a bearish engulfing candle. The stock quickly rolled over and took an almost 5% dive in under 30 minutes. Using the same chart from above, we can see that the rally off the first low created a near term overbought scenario. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that bottom.

- Adjust the indicator, and test it out with paper trades before using the indicator for live trades.

- Quite often, this rollback completes near the previous local low.

- The bandwidth, i.e. difference between the upper and the lower Bollinger Bands, corresponds to market volatility.

- When the price is constantly above the SMA, and hitting the upper band for a longer period of time, the market is in a trend.

- Most technical traders aim to profit from the strong uptrends before a reversal occurs.

As an example, we will use standard parameters – a 20-bar moving average and a multiplier with a factor of 2. At the same time, the price should not be outside the channel for longer than several candles. In range-bound markets, mean reversion strategies can work well, as prices travel between the two bands like a bouncing ball. However, Bollinger Bands® don’t always give accurate buy and sell signals. When trading with Bollinger Bands, traders should understand that standard settings will not suit all strategies.

bill williams 3 lines: Teeth, Jaws and Lips: How to trade with the Alligator Indicator DTTW

Содержание

No matter how good the indicator is, you always need to get confirmation of a signal. Let’s take a look at the indicators you can use together with the Alligator. https://forexbitcoin.info/ As the Alligator stands for the trend indicator, it’s worth combining it with another trend indicator but the one that uses a different methodology.

Is Williams Alligator a good indicator?

Bill Williams' Alligator indicator provides a useful visual tool for trend recognition and trade entry timing, but it has limited usefulness during choppy and trendless periods. Market players can confirm buy or sell signals with a moving average convergence divergence (MACD) or another trend identification indicator.

The red rectangle is the mouth opening for the alligator to eat again, this time driving to the downside. According to the description Bill Williams himself uses, there are a couple of ways to describe what’s going on. The indicators are known as the jaw, the teeth, and the lips of the alligator. Although Williams describes this as an alligator, it’s essentially just three moving averages. It’s because of this that it should be relatively simple for most traders to start to use it almost immediately. The Alligator indicator has a unique formula that distinguishes it from a simple set of moving averages.

What Is The Williams Alligator Indicator?

If it looks like the trend is set to continue, and a bearish engulfing candlestick occurs, this could be a signal to sell. Remember to set a stop a few pips above the high of the engulfing candle. To get the alligator indicator formula, the physician philosopher’s guide to personal finance you must first determine the median price of each candlestick, which is calculated as (high price + low price) / 2. Forex trading strategy with Keltner Channel Indicator. Indicator description, settings, entry, and exit conditions.

We can conclude that his intention was to improve trader’s awareness about the state of the markets and help them with market timing by signaling trading markets as they start forming. Closer to the top of the chart you see that there is an orange arrow, as the Alligator Indicator starts the clothes it’s jaw again. Furthermore, the histogram on the oscillator has started to drop, suggesting that perhaps momentum is starting to wane a bit. After that, the red arrow signifies the jaw opening yet again for the alligator to eat, while the MACD histogram is starting to drop much lower and well below the zero line.

- When it breaks above both moving averages, it’s a signal to buy.

- I should note that the longer is the timeframe, the more reliable are the signals generated.

- The Alligator’s Lips are the period 5 Simple Moving Average indicators in the median (High + Low) / 2 value which indicates the price predictions of 2 bars in the future.

- The Alligator indicator was created by Bill Williams, an American trader, and psychologist.

- The price moved in momentum for about 30% of the entire time; it trades in correction or accumulation for 70% of the time.

The next set of arrows are orange, because they show a slowing of momentum. At this point you have the option to either close the trade or perhaps move stop losses up a bit closer. Shortly thereafter, there are signs of life again as the Alligator Indicator starts to open its jaws again, and the MACD histogram starts to rise.

How to trade forex using the alligator indicator

When the alligator is sleeping, it’s best to stay out of the market. When it wakes up is when you should tackle the market with it. 3) The Alligator’s Lips, the “Green” line, is a 5-period Smoothed Moving Average, moved by 3 bars into the future. Having activated these stop losses, the market goes down, which is a huge disappointment for traders. There is a high probability that the peak of buys at number 6 has a significant number of shorts that are closed by stop losses set above 1780 level. Indicates the exit from the long position, as the green line moved down.

A perfect downtrend is when the blue line trades above the red and green lines. Once you click Okay, the indicator then appears on the main price chart. There are three moving averages, which are set at 5, 8, and 13. In testing the alligator indicator, I have found that hunting hand in hand with the alligator works better than all the other moving average crossover systems I have used.

When these lines are far away, You can also say that the mouth of the alligator is open, and the alligator is awake. A Weighted Moving Average is a type of moving average that puts more weight on recent data and less on past data. A moving average is a technical indicator that shows you how the price has…

Bill Williams introduced the Alligator which is a system that uses three displaced moving averages to isolate market trends. Bill Williams is the author of several trading books that touch on the chaos theory. A Moving Average is a technical indicator that averages a currency pair’s price over a period of time. Moving averages are highly popular among forex traders, mostly because of their… Fans of the Tradingsim blog know that I am big on volume. Volume is probably one of the oldest off chart technical indicators you will find in technical analysis.

Smoothing of the TEMA Indicator

The Alligator indicator is a technical indicator which based on three simple moving averages with different periods and forward offset. It was developed by Bill Williams, the author of “Trading chaos” and “New dimensions in stock trading” books. He devised a trading system to predict a Forex price action on the basis of several indicators including the Alligator technical indicator. The triple exponential moving average, also known as the TEMA, is a single line configuration on the chart. It smoothes the price of the equity three times using an EMA formula and then calculates the change in the EMAs based on the result for the previous day (n-1). Traders use the TEMA to enter and manage trades during strong trending markets.

How do you use Bill Williams 3 lines?

- The green line indicates the lips – this level is the weakest and has the fastest reaction to price changes.

- The red line indicates the teeth – the line is the average support/resistance level of the strength.

- The blue line indicates the Jaw – this one is the strongest line.

The Alligator indicator was invented to determine the state of the market. The Alligator indicator was created by Bill Williams, an American trader, and psychologist. Williams described the Alligator indicator in his book ‘Trading Chaos’ in 1995. It generates entry points at the very beginning of the price trending movement. The fractals indicator plots local highs and lows where the price may potentially stop and reverse, or even breakout. The Awesome oscillator measures the momentum of the underlying trend and also helps in confirming trends as well as warning of potential reversals.

Step #1: Apply Both Fractals and Bill Williams Alligator Indicator on Your Chart

This is one where the majority of traders don’t bother opening a trade. Futures, futures options, and forex trading services provided by Charles Schwab Futures & Forex LLC. Trading privileges subject to review and approval. Forex accounts are not available to residents of Ohio or Arizona. And since Bill Williams said, most money is made when market is in a strong trend, you can easily use this indicator to find and avoid range markets. The TEMA shows a single curved line, which is formed by a triple smoothed exponential moving average formula. The Alligator indicator displays three lines, while the TEMA has only one line.

When it breaks above both moving averages, it’s a signal to buy. Bill Williams refers to these moving averages as “balance lines”. You can see that he also gave creative names to the indicator and its elements.

The Alligator indicator leaves enough freedom for building trading strategies. You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money. When the indicator forms two highs above the zero level and the trough between them doesn’t plunge below 0, the signal is bearish. The second high must be lower than the first one and be followed by a bearish bar.

Stop Loss and Take Profit for a long trade

At this moment, you cannot open positions against the trend. Traders who enter trades against the trade by mistake are doomed to failure. In a trading range, the Alligator’s “mouth” is closed. With the beginning of the trend, it begins to “open up” and “eat.” Let’s take a look at what signals the Alligator generates.

Before we look any further into this strategy, here is what will make the strategy “reset” and invalidate a future trade BUY entry. The fractal trading system really works great at identifying short-term swing highs and lows. Today, we will dive into a strategy that trades with the Bill Williams Fractal Indicator/ Bill Williams Alligator. The main idea of this Forex indicator is to send a signal when a trend has just started. The Aligator indicator is one addition to the lagging indicators out there.

With that in mind, the indicator by itself won’t be sufficient enough to have a working system built around it. Granted, it can give you an idea when to get in and out of the market, but it also could cause a lot of choppy results if you are not cautious. The alligator indicator comes built into the Metatrader platform, therefore attracts a lot of attention due to that alone. Here’s a trading system you can apply to trending markets such as the currencies. The next article in this series on the Alligator indicator will discuss how this indicator is used in forex trading and how to read the various graphical signals that are generated.

Alligator’s Lips is the fastest moving average among the three. It’s the 5-period moving average, which is shifted 3 bars ahead. 89.1% of retail investor accounts lose money when trading CFDs with this provider. Click the ‘Open account’button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification.

As we use the Alligator momentum indicator alone, without any additional filters, the stop-loss orders should be placed beyond the local lows and highs, depending on the trend. Take Profit levels are set at the breakthrough of important high and lows. This is the level of the previous bar local highs which shows the past performance of the asset’s trading dimensions. The target of an uptrend is to break through the important high.

MyTradeHost VPS Server Hosting Trading TradeStation Interactive Brokers TWS MetaTrader MultiCharts NinjaTrader

The minimum transaction size must also be taken into account. It determines how many dollars a position can be opened from. In conjunction with the minimum deposit, this value is also decisive for how many dollars should be deposited.

You can rest assured that our high performance servers are running 24×7, so you never miss a major trade again. Investors had a mixed reaction to a new batch of earnings news from banks, airlines and other companies, as well as the latest report showing another rise in inflation. They also kept an eye on the latest comments on inflation from the Federal Reserve chair, who reaffirmed the Fed’s view that the surge in costs across the economy is temporary. The Nasdaq composite slipped 0.2%, to 14,644.95, despite gains by several big tech companies including Apple.

Investors have been hunting for which banks could be next to fall as the system creaks under the pressure of much higher interest rates. There are also commissions – some are charged when you deposit or withdraw your money. When you deposit, you’re only going to be charged on credit/debit card transfers, and the bank transfers are free.

The Fed has pulled its key overnight rate to a range of 4.50% to 4.75%, up from virtually zero at the start of last year, in its fastest set of hikes in decades. Last month, it dialed down the size of its increases and highlighted progress being made in the battle to get inflation lower. The Fed has been trying to cool growth in wages to remove pressure on inflation, which remains far above its 2% target, and blowout figures could cause it to get more aggressive about rates. The S&P 500 rose 0.1% to 4,048.42 after coming off its first winning week in the last four.

The maker of electric vehicles delivered fewer vehicles from July through September than investors expected. Besides stocks, lower rates also boost prices for everything from cryptocurrencies to gold, which can suddenly look a bit more attractive when bonds are paying less in income. “Asian equities were positive on Tuesday after a corrective session as traders eye potentially oversold market conditions,” Anderson Alves at ActivTrades said in a report. TOKYO — Asian shares were mostly higher in muted trading Tuesday, as investors tried to digest a slew of economic data and awaited moves by the U.S.

In principle, we recommend starting with a capital of $ 500 and using no more than 5 percent of the total capital per position. What we have learned from the background check is briefly summarized in the experiences. This also includes our own opinions and evaluations of the respective results of our research. An overall assessment is not long in coming and shows how and where the advantages and disadvantages of the broker should be applied. Another important point of our background check relates to the awards that the broker may have already received in the past.

What are CFD Brokers?

West Texas Intermediate crude futures settled at $78.20 a barrel, up 96 cents, or 1.2%. Most providers are not only equipped for trading CFDs alone. Instead, they also include a part for currency trading and are therefore also to be called a Forex broker. If it is appropriate, we also clearly express our concerns.

Exclusive: ActivTrades CEO Alex Pusco on ESMA and Diversification Strategies – Finance Magnates

Exclusive: ActivTrades CEO Alex Pusco on ESMA and Diversification Strategies.

Posted: Fri, 08 Jun 2018 07:00:00 GMT [source]

Banks mostly fell even after several of them turned in solid earnings reports. Citigroup gave up an early gain and fell 0.3%, despite reporting a more than five-fold rise in profits, helped by an improving economy that resulted in fewer bad loans on the bank’s balance sheet. Wells Fargo rose 4% for the biggest gain in the S&P 500 after reporting its most profitable quarter in two years.

FOREX-1 @ NY4

As a result, there are no differences between the regulations of, for example, the BaFin, the FCA and CySEC. In principle, a regulation from a European country is worth no less than one from Canada. Unfortunately, there are still black sheep that do not have a license or whose regulation has not yet been issued. We would advise ahttps://forex-reviews.org/st registering there for the time being.

The federal government’s latest TFSA contribution limit increase took effect this year. On CTVNews.ca, personal finance contributor Christopher Liew outlines eight tips on how Canadians can get the most out of this popular savings account. Markets are also assessing the impact of a looming Western price cap on Russian oil. Five OPEC+ sources said OPEC+ is likely to keep oil output policy unchanged at its Sunday meeting, while two sources said an additional production cut was also likely to be considered. Brent crude futures settled at $83.03 a barrel, losing 16 cents, or 0.2%.

Our 2022 Transparency Report has landed

Most of Wall Street will soon begin reporting how much profit they made in the first three months of the year under such conditions. The path ahead for the Federal Reserve and other central banks has become much more difficult because of the banking industry’s struggles. Typically, the still-high inflation seen around the world would call for even higher interest rates.

Well-known sites such as Finanzen.de regularly award prizes and laurels to the CFD brokers, who distinguish themselves from the others by special things. Various awards, such as an award for customer satisfaction, are distributed. We take a look at what the broker of our test has already been awarded from the highest place in the past. The differences between the brokers can be just as great as the number of brokers.

It is especially good if you have some experience and you are trying to have a scientific and volatility adjusted approach in running your portfolios. However, if we will dig up a bit deeper, we will found out many smart tools aren’t available for MetaTrader 5 and ActivTrader platform. The entrance threshold is 10$.The more you deposit, the more chances to create a good risk management strategy you have, and the fewer risks you should take on yourself. Hence it’s directly connected with your activity’s profitability.

CUSTOMER SERVICES

They are also very plentiful when it comes to features, activtrades forex, and technology. It’s a very good and convenient provider overall – again, as you’ll see. All of these instruments can be traded on the popular platforms MetaTrader 4 and MetaTrader 5. Of course, I saw brokers that offered 5 or even more platforms, however if we will count up all of them here including mobile apps, then it’ll be a solid quantity.

- Inflation at the wholesale level jumped 1% in June, pushing price gains over the past 12 months up by a record 7.3%.

- The overviews are too small to be able to make good decisions based on the courses.

- That is positive for workers, but the Fed worries strong employment might fuel inflation.

- In energy trading, benchmark U.S. crude fell 78 cents to US$72.35 a barrel in electronic trading on the New York Mercantile Exchange.

- The yield on the 10-year Treasury, which helps set rates for mortgages and other important loans, rose to 3.53% from 3.37% late Friday.

Poor customer support is a great indicator that you shouldn’t bother with a particular provider. A good customer support is very often an indicator of an honest and transparent organization. You can explore them all in the ‘tools’ section under ‘platforms’ on the official website of ActivTrades. The tools, however, are the technical instruments designed to improve your trading experience. Most can only be installed onto your MTs, which is a good reason to use them.

Trading software

Monitor the heartbeat of your server, trading application, strategy and even your trading data 24 hours a day so you never miss a single tick. Experts to customize your trading platform, network and computer server to exactly the specifications you need for trading success. Tuning your trading servers for optimal peak performance in CPU, disk, cache, data, processes and operating systems gives you an edge. Rest assured that data center staff and high level managers are available to solve issues to keep your servers and network always running. Our expert support team can answer all your questions about high performance trade hosting. The Better Business Bureau says Canadians fell for home improvement scams the most in 2022, in a report highlighting the riskiest scams and how much money they cost Canadians.

I join and learn about finance and trading way more than I do trades there. Don’t get me wrong, I am not trying to overpraise this company but the platform is simply one of the best definitely. You can run every type of portfolio you have got going on here.

They tend to be some of the biggest beneficiaries of lower interest rates, which can boost demand by investors for high-growth companies. I was pretty delighted when I opened demo account with ActivTrades. It was surprising for me that platforms can work without any interruptions and freezes. I haven’t started trading on a real account yet, as these days I try to trade on the demo. Many traders decline using demo trading, while I am convinced that it’s handy for everybody.

red clause and green clause lc: Green Clause Letter of Credit

Содержание

A red clause LC offers the requisite credit injection to bolster their working capital and accelerate their supply chain operations. Using the advances received due to the red clause, they can produce goods and make them available for sale quickly and efficiently. Therefore, a red clause LC speeds up their overall logistics and supply chain operations. The importer will give an instruction to the advising bank for a percentage of credit prior to shipments. The credit amount commonly provides in local currency and will be against security from the exporter. Funds will be adjusted when documents are presented and goods are shipped.

The buyer adds the “red clause” allowing the bank to issue advance or credit to the seller. The amount of advance is, however, deductible from the face value of the letter of credit. Deferred Letter of Credit is a type of Letter of Credit in which a conditional undertaking is taken by the bank to pay the seller on behalf of the buyer on a specified future date after completion of the transaction. You can invoke this screen by typing ‘LCSILUTL’ in the subject at the prime right nook of the Application tool bar and clicking on the adjoining arrow button. The system displays the Quantity or License Amount captured for the products code of import license.

- Both parties use an intermediary, namely a bank or financier, to issue a Letter of Credit and legally guarantee that the goods or services received will be paid for.

- The issuing bank undertakes to pay the amount of shipment to the seller, provided the latter submits the shipping and other documents of title as stipulated in the LC through the bank of the seller.

- In these cases, the original beneficiary of the LC makes the documentary credit available to the actual producer of goods, without making use of his own credit lines from his banker.

- Additionally, it means that you can safely offer your goods and services to any buyer around the world, with little risk that the products you have provided will not be paid for.

- Originally these letters of credit were written in red ink, so they are called red clause letters of credit.

The issuing bank may have its own branch at the place where the beneficiary is located or may arrange with a correspondent bank operating at that place in order to render advisory and authentication services. Green clause LCs boost the working capital of sellers and manufacturers. Free carrier is a trade term requiring the seller to deliver goods to a named airport, shipping terminal, or warehouse specified by the buyer. According to reputation, the Australian Wool Trade was home to the creation of Red Clause Letters.

The Digital Revolution of Receivables Finance in GIFT C…

In contrast, the availability of advance can be expanded to 75% to 80% of the face value of the letter of credit under the green clause letter of credit. To understand the green clause letter of credit, it is first important to understand the red clause letter of credit. Occasionally, a red clause letter of credit will require a declaration of intent, where the exporter must explicitly state how it intends to use the funds from the advance. When managing business across international borders, importers might have a fear that the exporter will not pay or deliver. Red Clause LCs based on collateral put pressure on sellers to speed up their supply chain processes to meet the LC’s payback terms.

The adjoining choice https://1investing.in/ing shows all party varieties obtainable for the LC. When you choose an recommendation code on this display, the advice code collectively and the party sort, to which it’s to be sent, is displayed within the FFT part. This indicates that the FFTs that you just specify will appear on the recommendation, which is displayed and might be sent to the celebration sort that is displayed. The system validates the BIC code maintained in ‘Address 1’ field of the Advising Bank or Issuing Bank of LC contract with code maintained at ‘BIC Code Maintenance’ degree. If the BIC code maintained in ‘Address 1’ area of LC contract just isn’t an ADB member, then the system displays an override message. Find out more about the different types of Letter of Credit in the next page of our LC guide,here.

Uniform Customs and Practice For Documentary Credits (UCP)

Benefit of using LC & SBLC is that, the buyer gets an assurance of receiving his product or merchandise on time, and the seller gets assurance of being paid on time on completion of the job. Select the template ID from the adjoining choice list.Template ID is relevant solely when the celebration type is applicant bank or issuing bank. You can invoke the ‘Letters of Credit Contract Reassign’ display by typing ‘LCDTREAS’ within the field at the prime proper corner of the Application tool bar and clicking on the adjoining arrow button. Every Letters of Credit transactions that you enter manually should be verified and licensed.

It provides credit facility to the exporter not only for the purchase of raw materials, processing, and packaging goods etc. but also pre-shipment warehousing at the port of origin and insurance expenses. Normally credit is sanctioned when the purchased goods are stored in bonded warehouses. This type LC usually used in the transactions relating to commodity market like wheat, rice, gold etc. RED CLAUSE AND GREEN CLAUSE LETTER OF CREDIT– Under the red clause letter of credit, the exporter can get advance money from the negotiating bank. One of the critical issues in an International Trade is that the buyer and seller must agree upon during negotiations is the manner of settlement of dues against the goods purchased or services provided. There is no “one size fits for all” formula that can applied on all types of International Trade.

Important Links

First Published in 1933 by the ICC and revised versions were issued in 1951,1962,1974 and 1983 and in and then replaced by UCP 600 with effect from 1st July,2007. A significant function of the ICC is the preparation and promotion of its uniform rules of practice. The ICC’s aim is to provide a codification of international practice occasionally selecting the best practice after ample debate and consideration. The ICC rules of practice are designed by bankers and merchants and not by legislatures with political and local considerations. The rules accordingly demonstrate the needs, customs and practices of business. Because the rules are incorporated voluntarily into contracts, the rules are flexible while providing a stable base for international review, including judicial scrutiny.

Offering discounts to obtain advance payments can result in a costly trade deal for the sellers in a competitive market. The sellers or exporters require cash to procure raw materials and inventory. One way of securing the cash is to obtain an advance from the buyers requiring the products.

Types of Red Clause Letter of Credit

The buyer requests an ILOC from his red clause and green clause lc institution, which is then sent to the seller’s financial institution. Under this LC, the issuing bank makes an advance payment to the exporter to support by providing working capital to buy raw materials and pay for the processing and packaging of goods to be exported. On the other hand, a Green Clause Letter of Credit not only pays for processing, packaging and raw materials, but also ensures payment for pre-shipment warehousing at the origin port and other insurance expenses.

These types of company need to be certain that they will not suffer losses from selling to overseas buyers that they are unfamiliar with. Mr. Tim makes the payment of USD 10,000 to the Bank of India (100%) along with the interest for the 50% advance payment that has been paid by the Bank of USA earlier. Mr. Ohio starts the shipment procedure and ships the goods to Mr. Tim upon receiving the advance payment. Such an LC authorizes the designated negotiating bank to make clean advances to the beneficiary and such a negotiating bank is under no obligation to such advances.

Credit is a contractual agreement in which a borrower receives something of value immediately and agrees to pay for it later, usually with interest. These letters of credit can be more expensive than regular letters of credit, however. The Beneficiary is provided with credit that may have not been otherwise available, whether that be locally or with cheaper financing. It removes the hurdle of non-availability of credit facilities for the seller. The adjoining possibility listing shows all party IDs available for the LC.

More articles by this author

Once the bank receives the documentation that ensures goods are stored in the warehouse, it issues a Letter of Credit. A Letter of Credit is a legal document provided by a bank or a financial institution, that guarantees that the exporter will be paid the full and correct amount on time. The issuing bank acts as a mediator between the parties and provides the exporter with an advance payment or guarantee of payment from the importer. When one party gives an advance payment to another party in any transaction, there is always a risk that the receiver may take the money and runoff.

The text of the standby LC is different from that of other traditional LCs, where the beneficiary is entitled for payment once he has submitted the documents in strict compliance with the stipulations in the LC. Often a business enterprise needs to purchase a particular type of material on a regular basis and, therefore, repeats the purchase order with the same supplier. This is required to replenish the stock of the said material, when exhausted. In such cases, the buyer may request the bank to issue a letter of credit for a specific amount, which will get automatically reactivated after the documents are paid for by the buyer and payment is made to the seller.

How exporters can access shipping funds – The Standard

How exporters can access shipping funds.

Posted: Thu, 09 Feb 2023 03:56:47 GMT [source]

In contrast, with a Green Letter of Credit the percentage is far greater – 75-80% the total value of the Letter. It is an LC that does not allow the issuing bank to make any changes without the approval of all the parties. The definition of “Parties to a Credit”, therefore includes only those that have express obligations under the credit and non-other. The UCP has received worldwide acceptance, its rules have been tested in courts of law and various arbitration proceedings, case laws and judicial pronouncements are available that make a reference to UCP articles.

Get the latest from Trade Finance Talks

When you click on ‘Default’ button, the system defaults the share of contribution maintained beneath ‘Joint Venture’ sub-display screen of ‘Customer Maintenance’ screen. In case you choose the same linkage reference for a couple of document within the list, the system displays an override message. Specify the shopper number of the celebration whose credit score limits have to be tracked. The choice list displays the customer numbers of all of the events selected under ‘Parties’ tab. However, you should ensure that the necessary get together particulars have been maintained under ‘Parties’ tab of the display. While LC is used as a primary method of payment, SBLC is used when there is buyer’s non-performance during the sale.

If has brought into one place some of the frequently occurring areas of confusion, has codified them, and has framed some practical standards for use in documentary credit operations. The ISBP goes a long way in reducing discrepancies in documents and consequent interruption in international trade. Financiers make advances against the presentation of warehouse receipts or similar documents together with the exporter’s undertaking to deliver the bill of lading upon shipment. The amount, which is provided in a local currency and against security from the exporter, is repaid when the documents are presented and goods are shipped.

C albicans CDC4 CR_01680C SummaryLast curated 2022-04-19See the Literature Guide for most recent publications.

Contents:

In their analysis, Omran et al. describe the use cases of blockchain for reverse factoring and dynamic discounting. Reverse factoring can be optimised because blockchain enables invoice status information to be transferred securely, allowing financiers to offer high-frequency financing services for any transaction value at lower risk . In conjunction with smart contracts, blockchain can improve the access to reliable real-time information and automate decision-making through the integration of financial and informational flows in supply chains . That way, the risk premium of an early payment financing proposal can be continuously adjusted at each step of the material flow . Hofmann et al. discuss applications in various buyer-led SCF techniques and examine a new solution that implements blockchain-based reverse-securitisation.

We argue that blockchain technology has an innovation promoting role in supply chain finance solutions through reducing inefficiencies and increasing visibility between different parties, which have hitherto constituted the main challenges in this sphere. Based on a review of the academic literature as well as an analysis of the industrial solutions that have emerged, we identify and discuss the financial, operational and legal challenges encountered in supply chain financing and the promise of blockchain to address these limitations. We conclude by identifying promising research directions about the implementation process, inviting further research into the transformation of business models toward a more collaborative nature.

Many proof-of-concepts, piloting, or entering production schemes have been developed in the last five years. The purpose of this section is to analyse these newly emerging blockchain projects in trade and supply chain finance and to identify how they enhance existing processes. Table 3 presents a list of popular blockchain-enabled SCF initiatives identified through a practical case-based research on the grey literature. Firm executives may take advantage of excessive cash holdings for personal benefits and subsequently destroy firm values (Myers and Rajan, 1998; Pinkowitz et al., 2006; Dittmar and Marhrt-Smith, 2007). On the contrary, insufficient cash holdings may induce liquidity issues in the supply chain with increased risk of bankruptcy.

Since subtle differences can cause changes in cell fate, accurate regulation of these signals is a prerequisite for successful differentiation. In recent years, more and more studies have found that protein ubiquitination has become an important regulator of cell fate and function. Abnormal of SCF complex usually leads to birth defects, pediatric diseases or cancer. By forming conjugates of different topologies, ubiquitination can affect the stability, interaction, localization or activity of thousands of proteins, resulting in a wide range of specific signals for cell control . Although some positive regulators of self-renewal have been discovered, little is known about negative regulators. FBXW7 (F-box and WD-40 domain protein 7) is an important negative regulator of SSCs self-renewal.

Other Literature Sources

Human trophoblast progenitor cells differentiatein two different pathways, either to become highly invasive cytotrophoblast cells and extravillous trophoblast cells or to integrate into syncytio trophoblastic cells A Contribution to the SCF Literature . Incomplete trophoblast differentiation can cause poor placental perfusion and even pre-eclampsia . Studies have shown that Cul1 is highly expressed in CTB and EVT in human placenta during early pregnancy.

However, the authors offer the caveat that their study focuses on older workers and younger workers may have a different response to employer matching. Other research, such as that reviewed by Munnell and Sunden more strongly suggests that the existence of an employer match increases the likelihood that employees will enroll in a retirement savings plan, while also increasing contribution levels. The PPA also amends the Internal Revenue Code to add a design-based safe harbor for plans that use automatic enrollment. Matching provisions are also part of the PPA rules governing safe harbor, and a discussion of these rules is included later in this article. The most basic feature of a retirement savings program, and one that plays a significant role in determining participation rates, is the enrollment approach used in the plan.

Related Pages & Pathways

They also find when employees use the education provided, median plan balances are $10,000 compared with only $4,000 when available educational offerings are not used. These findings demonstrate how important the availability of financial education can be as a tool in helping achieve the goals central to all retirement savings plans. Another important aspect of retirement savings programs is the method through which funds are paid out of the account. The rules governing the distribution of funds, https://forexarena.net/ both before and after retirement, can have a dramatic impact on plan participation, contribution rates, and the maintenance of an adequate postretirement replacement rate. Another important component of many retirement savings programs is an employer match, in which employers make a contribution to a participant’s account based on the money already invested, up to a predetermined point. The match is used as a tool to increase participation and savings levels, as well as contribution rates.

SCF Names Brittany Nielsen VP for Student Services and Enrollment – State College of Florida, Manatee-Sarasota

SCF Names Brittany Nielsen VP for Student Services and Enrollment.

Posted: Tue, 17 Aug 2021 07:00:00 GMT [source]