Contents:

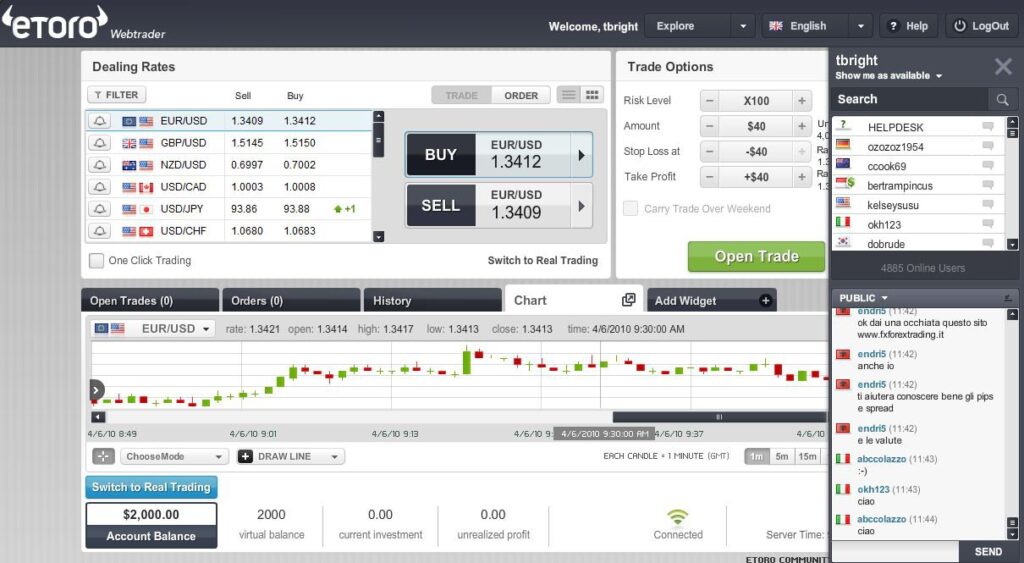

Any financial numbers referenced here, or on any of our sites, are illustrative of concepts only and should not be considered average earnings, exact earnings, or promises for actual or future performance. Use caution and always consult your accountant, lawyer or professional advisor before acting on this or any information related to a lifestyle change or your business or finances. However, we can still use it with certain markets such as the DAX in Europe.

3 Factors that determine your Professional Trading MindsetMany traders who are new to the subject experience… Many full-time workers are intimidated by trading on the stock market, and one of the main reasons is the time aspect. In addition to work and family, there is often not enough time to fully understand the matter. Swing trading based on the COT report offers the opportunity to reduce the time investment.

Lesson #4: Use the market’s volatility and cycles in market volatility

A retracement from its upper and lower limits could be used for opening https://forexarena.net/ and long positions, respectively. Much will depend on the closing price of the breakout bar. LARRY R. WILLIAMS has been trading for almost fifty years and is one of the most highly regarded short-term traders in the world. Between trading, researching, and developing trading tools, he ran twice for the U.S. The Mayor of San Diego declared October 6th, 2002 “Larry Williams’ Day.” Larry has been featured on CNBC and Fox News, and has been interviewed and quoted in more publications than he can keep track of.

- Simply add the indicator to your chart, see where the peaks and troughs line up between price and the indicator, then look ahead to see if any price trend reversals are expected in the future.

- Without breaking any confidences, revealing specific setups, etc. these are the general principles, observations and what I’ve learned from reading and watching Larry Williams trade.

- But on the positive side it did get me to switch from a purely systematic approach to a discretionary approach.

It would be hard to imagine a better situation for opening a long position in EUR/USD from the level of the bar’s closure. A protective stop-order, like in the previous example, was supposed to be placed below the fluctuation minimum and above a psychologically important level of 1.1. The Williams Advance/Decline Line can be used just like a more traditional version of this market indicator, to show the level of participation in a market move. Since it covers the NYSE, it is best used on daily charts for US stock market averages. Larry recommends overlaying the AD Line on the price plot for the market average, then looking for divergences between the two.

larry-williams

The https://forexaggregator.com/ Sentiment Index can be used on weekly or daily charts. When the Sentiment index rises above the blue line, this is a signal to sell; conversely, when it drops below the red line, this shows strong bearish sentiment and is a signal to buy. By default, those thresholds are set at 75 and 25, but can be adjusted to meet your trading needs. Trading futures and options involves substantial risk of loss and are not suitable for all investors. Veteran traders have learned the hard way and have scars to prove it – Never try to guess the exact timing of reversals in the market. The R% indicator is helpful in suggesting when a reversal might be imminent, but it is prudent to use another technique to confirm that a change in direction has taken a stable turn.

Jays hire former Astros GM Click as baseball strategy VP – Daily Independent

Jays hire former Astros GM Click as baseball strategy VP.

Posted: Mon, 27 Feb 2023 19:10:05 GMT [source]

But I’ll give you as much insight as I can – without breaking any confidences – about the way he trades and what I have learned. Unfortunately, he didn’t end up making money that session and so we never got a refund of the cost to attend. It was about the time when I needed to take my trading really seriously. And so it was one of those things that I did that kicked me into a higher gear.

The Ultimate Oscillator by Larry Williams

Trading and investing in financial markets involves risk. The death of a thousand stops, or slippages, or commission fees is something that every day trader has experienced at some time or another. If you’re not careful, these extra costs can even exceed your trading profits, especially during a slow or low-return day.

Biscuitville Promotes Seven Leadership Team Members – QSR magazine

Biscuitville Promotes Seven Leadership Team Members.

Posted: Tue, 07 Feb 2023 08:00:00 GMT [source]

It works even better if you set a minimum size for this gap – maybe ticks. In this case, you’ll get a very effective setup that has been working very well for years and continues doing so. For those who don’t know it, a gap up takes place when the open is higher than the highest point that was reached on the previous day. Instead, a gap down occurs when the open is lower than the lowest traded point of the previous day. The currency market is going through a week of tension and stress with new forecasts for further action by the US Federal Reserve.

Work strategy for Larry Williams’ channel

Get comfortable with the R% https://trading-market.org/ and fine-tune your strategy as you become more acquainted. He rose to fame, however, by winning the World Cup Championship of Futures Trading in 1987. Over one twelve-month period, he was able to transform his beginning investment of $10,000 into an incredible amount of $1.1 million. News soon spread of his groundbreaking approach to trading.

- When the indicator is between -80 and -100 the price is oversold, or far from the high of its recent range.

- Its primary function is to identify overbought and oversold conditions.

- Ignore all short signals because the price above the 200 EMA, indicates an uptrend.

- When the index is low, there has been low acquisition of the security, which signals a possible decline.

Cory Mitchell, CMT is the founder of TradeThatSwing.com. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies. Neither Anthony Crudele nor Futures Radio Show Guest’s guarantees any specific outcome or profit.

I made a Free Trading Course I wish I got as an Absolute Beginner

These allowed him to make a faster and more accurate evaluation of a situation. The most well-known among these are the Williams %R, Williams Ultimate Oscillator and Williams VIX FIX. Larry Williams early on recognized the importance of properly using historical data. Since the infrastructure at the time was not even remotely comparable to today’s, he began to calculate and record everything by hand. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

In this interview, we cover many different topics including Larry’s background, methodology, super performance, risk management, entries/exits, and Trading Psychology. Today as our guest is Larry Williams a veteran and influential trader and author with over 60 years of experience. He is well known for willing the 1987 World Cup Championship of Futures trading with an incredible 11,300% in one year. As with every other indicator, the R% does have its limitations. A healthy practice regimen will reveal a host of valuable insights that this indicator can provide, but the R% at best can only highlight potential winning opportunities.

During his studies, Williams was already involved in the financial markets. After four years of observation, he started trading in 1966, initially as a stock trader. At first, he relied almost exclusively on chart technical markers, but he gradually lost money with this approach.

Doubling up with another oscillator like the RSI for trending markets and Stochastics for ranging markets can be another method. Volumes, chart patterns, candlesticks, and Fibonacci levels are helpful, too. You are shown Williams’ personal technique for picking stocks based on identifying what stocks are under professional buying or selling. In addition, you’ll learn how to successfully forecast the market’s short, intermediate and long-term trend; and be shown how to combine stock selection with market timing to improve your results.

It’s even better if the price opens much higher than the yesterday’s high. During the last stage of the downtrend, the market needs to gap down way below yesterday’s low. Basically, it is a gap trading strategy which means that it is based on fading the direction of the opening gap. This articles Strategy 9 1 Larry Williams The Best Strategy For Any Market The Best Strategy For Beginners is just regarding gorgeous demo considering like the reading remember to buy the first images.