Contents:

You can see how there is an obvious difference between where the pin bar opened and where it closed. If you’re looking for a dragonfly doji confirmation, you should pay attention to its next candle. Because understanding the meaning is what matters, not trying to memorize the exact candlestick pattern. So again, the close and the open is the same level but the difference this time around for Dragonfly Doji is that the candle has a lower wick. The three different types of Doji candlestick pattern that you must be aware of. Welcome back to this training video where you will learn all about theDoji candlestick pattern.

That often signs the end of the pullback and the start of the new leg to the upside. Just wait for a pullback to start, and then spot when the Dragonfly Doji appears. What makes a pattern valid is not just the shape, but also the location where it appears. The candle may or not have a wick at the top, but if it has, must be small. In the past, we have looked at several of these patterns, including evening and morning star, the hammer. And the gravestone Doji, which is one of the three popular Doji patterns.

In other words, dragonfly doji candle can means price exhaustion in a downtrend and potential price reversal. Dragonfly doji candle and gravestone doji candlesticks are very similar, and we discuss the difference further. Most of the technical indicators or patterns are indicative of reversal patterns.Hence they are neither bullish nor bearish. Also usually traders even if the pattern appears will wait for the next day to verify.

Get TrendSpider Apps

There are usually slight discrepancies between these three prices. The example below shows a dragonfly doji that occurred during a sideways correction within a longer-term uptrend. The dragonfly doji moves below the recent lows but then is quickly swept higher by the buyers.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

When you see this chart, it can difficult to just trade off it directly. It’s like a regular Doji but this time around, the highs and lows of the candle is very long. Whether you want to capture a swing or whether you want to capture a trend, you can use the appropriate trade management or trailing stop loss technique. You can go short on the next candle, stop loss above the swing high and depending on whether you want to take a swing or not. That is the key thing down here and you have to kind of anticipate that there are variations that could occur, especially in the FX markets.

Significance of Dragonfly Doji pattern

Tradingindepth.com is not liable for any damages arising out of the use of its contents. When evaluating online brokers, always consult the broker’s website. Tradingindepth.com makes no warranty that its content will be accurate, timely, useful, or reliable. Make sure you understand the difference between hanging man candle, hammer candle, and dragonfly doji to prevent from false interpretation. One thing to share first is don’t make this mistake when you’re trading the Doji candlestick pattern. And it’s really not too important to concern yourself whether there is a small body or no body on the candlestick pattern.

Of course, it occurs very rarely but price reversal happens constantly. Thus, this candlestick is not considered a good indicator for reversal patterns. They create orders immediately after the trend of confirmed by the next candlestick. Conversely, when the market has shown an upward trend before, a dragonfly doji might signal a price drop, known as a bearish dragonfly. The downward movement of the next candlestick will provide confirmation. A bearish abandoned baby is a type of candlestick pattern identified by traders to signal a reversal in the current uptrend.

As shown below, the dragonfly doji has a similar appearance to the hammer pattern or capital letter T. In this article, we will look at the dragonfly doji, which is another popular type of the pattern. Dragonfly Dojis are said to be red or green depending on the direction of their next candle. Dragonflies that appear during uptrends will often show as a green Dragonfly and vice versa for downtrends. In this article we will dive into how to spot a dragonfly doji. The best strategy to trade it and examples of how they have played out in the past.

Probability of a reversal

For example, the ability to withstand losses or to adhere to a particular dragonfly candlestick program in spite of trading losses are material points which can also adversely affect actual trading results. Support and resistance levels are great places to find price reversals. The Dragonfly Doji pattern is also a mirrored version of the Gravestone Doji candlestick pattern. Everything that you need to know about the Dragonfly Doji candlestick pattern is here. In most cases, a dragonfly doji is usually viewed as a more accurate sign of a reversal.

How to Read Candlestick Charts for Beginners • Benzinga – Benzinga

How to Read Candlestick Charts for Beginners • Benzinga.

Posted: Tue, 22 Feb 2022 08:00:00 GMT [source]

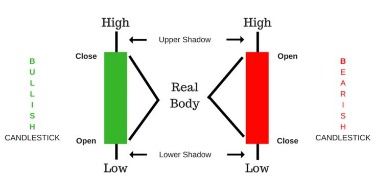

Dojis are differentiated by the location of the open and close on the wick — where trading begins and ends on a given day. A Doji indicator is mostly used in patterns, and it is actually a neutral pattern itself. By itself, the Doji candlestick only shows that investors are in doubt. However, there are main patterns that can be easily found on the chart. This candle pattern will help traders see the existence of support and demand. The problem with dragonfly and gravestone doji candles is there is no candle body, which makes it impossible for the candle to actually close into the body of the previous candle.

Candlestick Pattern

As you can see the price was in a minor downtrend when the price opened sharply lower and then ended the day close to where it opened. On the other hand, if the market has shown an upward trend previously and a formation might signal an upcoming decrease in the price of the security. The downward movement of the next candlestick will confirm the downward trend. The Dragonfly Doji is a specific type of candlestick pattern that can occur at the end of an uptrend.

The Dragonfly Doji candlestick pattern is formed by one single candle. Dragonfly Doji Candlestick, gravestone doji is a candle stick pattern with open, high, and low close patterns. In this case, traders may want to see if Dragonfly has any confirmation which will be seen in its next candle or candles after it occurs. The Gravestone Doji is a Japanese candlestick in which the open and close price of the candle is at the same level or is very close to the same level.

It is a transitional pattern as opposed to a reversal or continuation pattern. Traders should also note that just because you see a confirmation, that does not necessarily mean that there will be a reversal. Apart from the regular pattern of Doji, we also have the gravestone pattern.

The https://g-markets.net/ should be verified by waiting for trend confirmation on the following day. Naturally, dragonfly patterns form at the bottom of a downtrend or where the price has found support. Short Line Candles – also known as ‘short candles’ – are candles on a candlestick chart that have a short real body. Investopedia does not provide tax, investment, or financial services and advice. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal.

A doji is a name for a candlestick chart for a security that has an open and close that are virtually equal. Dojis are often used as components in patterns used to detect trading opportunities. Dragonfly dojis are very rare, because it is uncommon for the open, high, and close all to be exactly the same.

Its unusual ‘T’ shape indicates that a stock is beginning on a downward trend and reversing itself to close near the same price. As a result, dragonfly doji patterns are helpful in identifying potential trading opportunities. Dragonfly dojis gain significance when they are formed during the uptrend or the downtrend. The formation announces a potential reversal after a long downtrend in the stock prices, especially when the lower shadow is considerably long. Dragonfly doji means that sellers had the full control during the initial phase when the price opened and they took the price down to the lowest level.

Any candle which has a wick at the end tells us the banks took some kind of action during the time the candle was forming. This tells you that, “hey, the market is willing to buy at these higher prices, and there’s a good chance that this market could breakout higher and you can look to trade the break out of the highs.” You can see the market rejected higher prices and finally closing near the lows. Often what I see traders do is that when the market moves up higher and then there’s a Doji.

These candlesticks are neutral in color, such as black, and should be bought if the price breaks through a significant level of support. This doji candlestick formation is cautiously looked upon by the market players traders who follow technical analysis using price charts and patterns. Formation of dragonfly doji is used to decide the potential moves in the future – like, if already holding a position, then should it be closed at a profit or loss, or should it be held on to. A dragonfly doji candlestick pattern is formed when a candlestick has the same high, open, and closing prices. The candle can be on all timeframes, including on a daily, hourly, and 30-minute chart.